PropNex Picks

|October 16,2025F&B Strain Puts Pressure on Retail Spaces?

Share this article:

When COVID-19 swept across the world in 2020, the food & beverage (F&B) sector took a hit. During the circuit breaker period, dine-in was banned, many outlets closed, and non-essential businesses had to stop operations. F&B sales dropped by 26%, the worst it's been since they began collecting data in 1986.

But after the circuit breaker period was over, restrictions eased and the sector bounced back fairly quickly. F&B sales recovered to about 74% of pre-COVID levels. In fact, new businesses kept opening each month.

Fast forward to today, and new F&B businesses continue to open. In 2024 alone, 3,793 of them entered the market. But as it turns out, this surge may actually be doing more harm than good, because within the same year, 3,047 F&B businesses shut down, a record high since 2005.

Yes, the F&B market is getting "overweight," with too many players chasing the same hungry crowd. The problem is, in a small market like ours, the pie can only be sliced so many ways before businesses start struggling to stay afloat.

This doesn't just affect business owners. If you're a retail property player, you're gonna want to stay alert. Because when outlets keep opening and closing, it raises questions about vacancies, rents, and long-term stability. The big question now: Is this F&B strain going to backfire on you?

The F&B strain is changing how tenants view retail spaces. Being in a mall or shopfront once meant stability and visibility. Today, higher operating costs and unpredictable footfall can hurt business owners.

It's not just utilities, staffing, and raw materials that have become more expensive. Rent has also gone up. During COVID, landlords were pressured to offer rebates. But even then, landlords were not very willing. Now that their own margins are tighter, they may feel less inclined to extend such support.

That's why shorter lease options have become a big trend lately. Many tenants now prefer flexibility. Shorter commitments allow tenants to test locations before fully committing. While this gives them adaptability, it also means more frequent relocations, which may come at its own costs.

Many businesses are also downsizing their operations, focusing on takeaways, deliveries, and digital sales. They are also more cautious about expansions and lease locations.

Basically, as tenants are struggling to survive in today's F&B climate, they have to be more picky with rent.

On the other hand, landlords face their own issues:

- Pressure on non-prime locations

Not all retail spaces are created equal. Popular destinations like Orchard or Jewel can still easily attract traffic, especially from tourists. On the other hand, smaller malls and retail spaces in less trendy locations are left vulnerable since they tend to rely on independent food operators, who are more easily hit by rising costs. So while retail units at better malls or locations are holding ground, those in city fringe and suburban areas may experience flat, even declining, rents and rising vacancy. This two-speed market shows the gap between prime and non-prime spaces.

- Volatile rental income

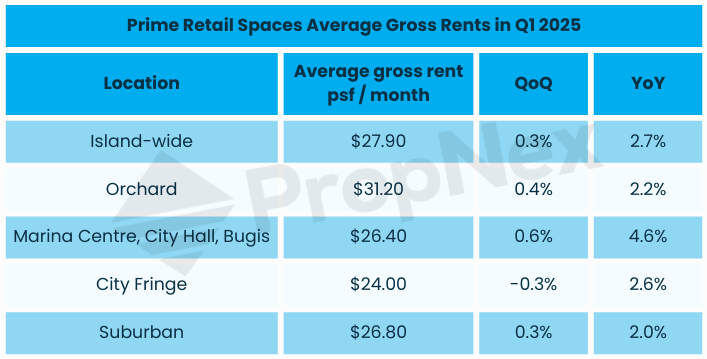

Every time an eatery closes down, landlords don't just lose rent for that month. They also face longer vacancy periods and the challenge of finding a replacement. Over time, this can add up to significant lost income, so landlords need to brace for less predictable cash flow. To top it off, rental growth across the island has been modest. In Q1 2025, rent for prime retail spaces barely grew. City fringe even experienced a 0.3% decline QoQ.

- More tenant replacement costs

Replacing F&B tenants isn't as simple as handing over the keys. Exhaust systems, grease traps, and fire safety requirements all mean heavy reinstatement and fit-out costs. When tenants turn over quickly, landlords are left footing more of these expenses, either to prepare a space for the next operator or to provide incentives to attract a stable one.

If we want the retail property market to stay resilient amidst the F&B strain, then it's not just landlords and tenants who need to adapt. Policymakers should also do something to shape a more sustainable retail landscape, a balance between supporting entrepreneurship while avoiding oversupply and unnecessary closures that destabilise the property market.

One possibility is better regulation of supply. URA already controls how much space in a development can be allocated for F&B, but the surge in openings suggests that the pie is still being sliced too thin.

Stricter caps on F&B floor area, or tighter controls on licences in saturated neighbourhoods, could prevent an overshoot of outlets chasing the same customers. This would help reduce the cycle of rapid openings and closures that hurt both operators and landlords.

Another approach could be to incentivise resilience. Instead of just supporting start-ups, there should also be schemes to help existing businesses scale sustainably. For example, providing grants or tax incentives tied to digitalisation, productivity improvements, or similar initiatives.

And since URA is pushing for decentralised hubs (as we've seen in the latest masterplan), then it would be critical to align retail and F&B growth with the amount of residents and workers. That way, new malls and dining clusters are opened where demand truly exists, rather than allowing concentration in already saturated zones.

Clearly, this isn't a problem that will resolve overnight. And if you are an F&B business owner or you retail property owner, you can't afford to sit and wait for policy tweaks that may take months or never come at all.

For tenants

If rent is too much for you right now, consider running a home-based business instead. You can focus on catering, delivery, or pre-orders. This reduces costs but still keeps your brand alive and customers fed. Just take a look at Chef Pristina Mok. She used to work for Michelin restaurants, and now she runs a fine-dining restaurant out of her public housing flat! Of course, there are regulations about home businesses, which you can read more about here.

You can also diversify your revenue streams through merchandise and pop-up collaborations (like what the chefs from Taste Paradise and The Wood Ear did last year). It may just be enough to help you survive slower months.

Digitalisation also helps. Self-ordering systems and data-driven marketing can reduce manpower costs and speed up workflow. Plus, maintaining an online presence and engaging customers through social media can do wonders for visibility and brand loyalty.

For those who are looking for a new space, be picky about location. Don't just rush into any mall. Instead, study the catchment demographics, nearby office or residential density, and competing brands. Sometimes, a smaller unit in a mature heartland estate with strong repeat customers may outperform a downtown outlet with high turnover.

Another option to consider is taking the hawker route. Several former caf owners and chefs have moved into hawker stalls. It offers lower rent, simpler operations, and a steadier customer base. Many have found success reinventing their brands in food courts or hawker centres where daily demand is consistent.

And as mentioned before, you can also look for shorter-term leases for more flexibility. And don't shy away from negotiating, regardless of whether you're signing a new lease or renewing an old one.

For buyers and investors

Likewise, you also need to focus on location. Prime areas like Orchard and Marina Bay will continue to attract international brands and foot traffic, but they're also highly competitive and expensive. Secondary malls in mature estates can still work, but only if they have strong anchor tenants, good transport links, or are tied to an integrated development (think MRT station, office tower, or residential area). Without these, you risk when smaller F&B players start to struggle.

Aside from that, you need to choose your tenant carefully.

An attractive F&B tenant may look like a safe bet, but in today's climate they can be volatile. So, consider tenants in essential services like clinics, tuition centres, minimarts, laundromats, and beauty services. They tend to stick around longer because they serve daily needs and face less cut-throat competition. But, if you must rent to F&B, look for operators with a proven track record, a hybrid dine-in and online delivery model, or strong digital marketing presence.

You can also evaluate your lease structures. Shorter leases may feel safer in a volatile market, but they also mean more turnover and higher replacement costs. If you can secure tenants with proven track records, locking in slightly longer terms can make your cash flow more stabile. But this may be challenging since tenants currently prefer shorter leases.

Last but not least, build in buffer for costs. Tenant replacement, fit-out allowances, and void periods are not one-off risks. They're part of the new normal in retail. Investors should budget realistically for these, rather than assume full occupancy and uninterrupted rent.

The F&B strain is more than just a problem for caf owners or hawkerpreneurs, it can destabilise the broader retail landscape. With closures at record highs, it's clear that "more restaurants" doesn't always mean a healthier market.

The way forward will need all sides to adapt. Policymakers can play a role by aligning F&B supply with real demand and supporting operators who can scale sustainably, not just new entrants. At the same time, tenants must find creative ways to survive, and buyers/investors must take a sharper look at the fundamentals.

Retail is far from dead, but the game has surely changed. That's why you need to stay informed and have good strategies. If you'd like to go deeper into that, join us at our upcoming Property Wealth Seminar Masterclass. You'll gain practical insights from industry experts and learn how to position your investments for the evolving property landscape.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.